ETF Leveraged Tokens Introduction

This section explains how ETF leveraged tokens work and defines their key parameters.

What are ETF Leveraged Tokens?

ETF Leveraged Tokens are fund products that utilize derivatives such as contracts to “replicate” the price performance of an underlying asset while amplifying its movements by a fixed multiple (e.g., 3x, 5x). These tokens add leverage to the underlying asset, allowing users to engage in leveraged trading without needing to pay margin or worry about liquidation risks, simply by buying and selling ETF Leveraged Tokens like spot trading.

In other words, ETF Leveraged Tokens magnify the returns of standard digital assets. When the target asset moves by 1%, the net asset value (NAV) of the ETF Leveraged Token changes by a multiple of that movement, such as 3% or 5%. If the leverage multiple is 1x, ETF Leveraged Tokens function similarly to traditional digital assets.

Unlike traditional ETFs, which track a basket of stocks or indices, ETF Leveraged Tokens track and amplify the price performance of a single digital currency.

Gate ETF Leveraged Token Symbol Convention

The symbol of ETF Leveraged Tokens consists of three components: “Underlying Asset,” “Target Leverage Multiple,” and “Direction.” For example:

- Underlying Asset : The underlying asset of the leveraged token is the cryptocurrency it tracks. For example, BTC3L and BTC3S both track BTC.

- Target Leverage Multiple : BTC3L and BTC3S have a leverage multiple of 3x, while BTC5L and BTC5S have a leverage multiple of 5x.

- Direction : BTC3L: A 3x long BTC token (L = Long) BTC3L is a leveraged token that holds a 3x leveraged long position in BTCUSDT perpetual contracts. Buying BTC3L means holding a 3x long position in BTC. If BTC’s price rises by 1%, the NAV of BTC3L increases by 3%.

- BTC3S: A 3x short BTC token (S = Short) BTC3S is a leveraged token that holds a 3x leveraged short position in BTCUSDT perpetual contracts. If BTCUSDT’s price drops by 1%, the NAV of BTC3S increases by 3%.

How Gate ETF Leveraged Tokens Work?

Gate ETF Leveraged Tokens are essentially funds managed and issued by professional financial teams, with an initial NAV of 1 USDT.

Each ETF Leveraged Token corresponds to a specific number of futures contract positions. The fund manager dynamically adjusts these positions through perpetual contract markets to maintain the target leverage multiple (e.g., 3x or 5x).

Gate ETF Leveraged Tokens use a rebalancing mechanism to dynamically adjust futures positions, ensuring that the fund’s NAV maintains a fixed leverage multiple over time (daily), amplifying potential returns. The fund manager charges a daily management fee of 0.1% of the NAV to cover contract market fees, funding rates, and other operational costs.

Example: How the Rebalancing Mechanism Works Since underlying asset price fluctuations can cause actual leverage ratios to deviate from the target, the fund manager periodically rebalances the positions to restore the intended leverage multiple.

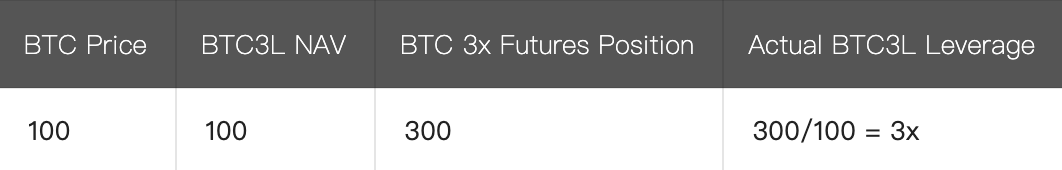

For simplicity, assume the current BTC price is 100 USDT, and the NAV of BTC3L is 1 USDT.

Scenario: A user purchases 100 USDT worth of BTC3L (3x leverage token)Initial State:

- The fund manager uses 100 USDT as margin to open a 300 USDT long position in BTC perpetual contracts (3x leverage).

BTC Price Increases:

- If BTC price rises 5% , the futures position increases 15% (5% × 3x).

- BTC3L NAV rises 15% to 115 USDT .

- Since BTC3L’s target leverage is 3x, the fund manager adds 30 USDT to futures positions, bringing the total position value to 345 USDT (115 × 3x), restoring 3x leverage.

Similarly, if the underlying asset price drops, the fund manager reduces positions to maintain the leverage ratio.

Gate users do not need to manage futures positions directly; they simply buy and sell ETF Leveraged Tokens on the spot market. When trading ETF Leveraged Tokens, users are buying into the fund’s NAV, not the actual cryptocurrency itself.

For more details on the rebalancing mechanism, please refer to: Gate ETF Leveraged Tokens Rebalancing Mechanism

Key Features of Gate ETF Leveraged Tokens

- ETF Leveraged Tokens are perpetual products with no expiration or settlement date, allowing users to buy or sell anytime.

- Trading ETF Leveraged Tokens is similar to spot trading—no margin or collateral is required, and there is no liquidation risk.

- The rebalancing mechanism makes ETF Leveraged Tokens ideal for trending markets. In such conditions, compounding effects can enhance returns. However, in volatile markets, frequent rebalancing can lead to greater decay.