Web3ExplorerLin

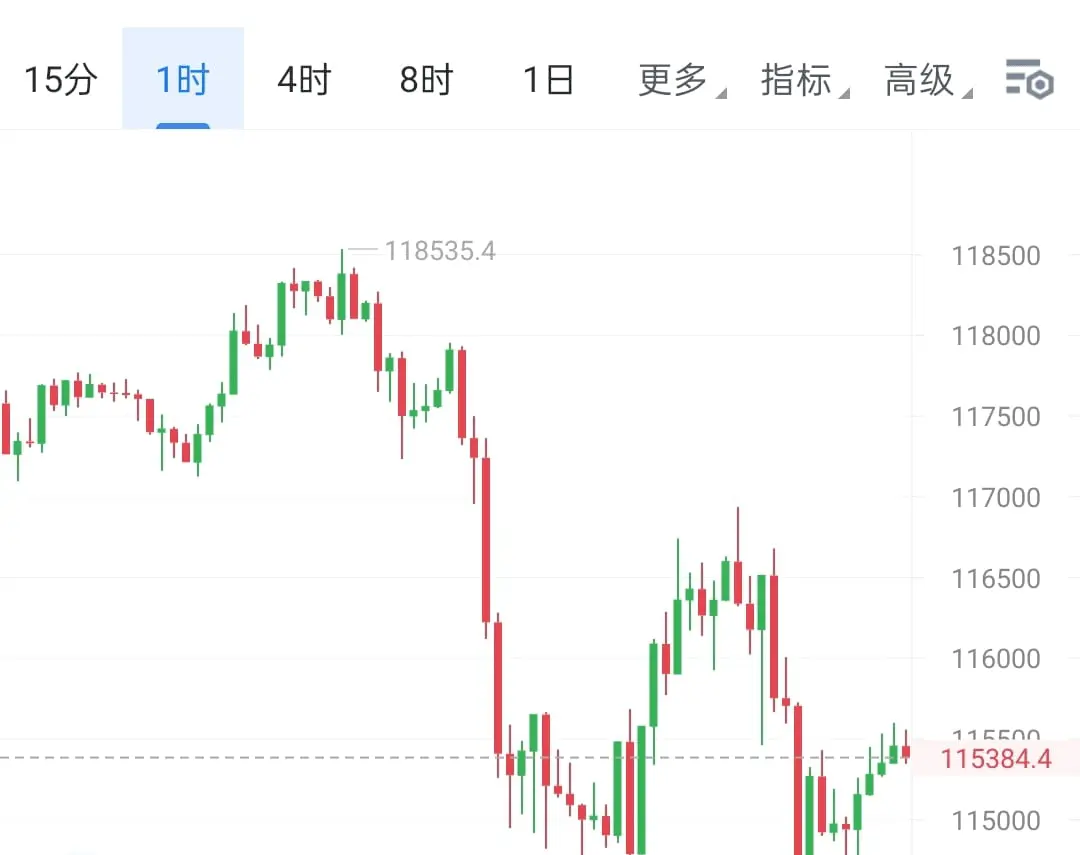

This week's Crypto Assets market situation is perplexing, and several important factors are worth following closely.

First, Federal Reserve Chairman Powell will deliver a speech at the Jackson Hole annual meeting, and the market generally expects that he may hint at the prospect of interest rate cuts in September. This is undoubtedly the most watched economic event of the week, and its potential impact on the Crypto Assets market cannot be ignored.

Meanwhile, despite Bitmine and Ethereum ETFs continuing to buy, the price of Ethereum has still fallen about 10% from recent highs. This price tren

View OriginalFirst, Federal Reserve Chairman Powell will deliver a speech at the Jackson Hole annual meeting, and the market generally expects that he may hint at the prospect of interest rate cuts in September. This is undoubtedly the most watched economic event of the week, and its potential impact on the Crypto Assets market cannot be ignored.

Meanwhile, despite Bitmine and Ethereum ETFs continuing to buy, the price of Ethereum has still fallen about 10% from recent highs. This price tren