BCH Price Prediction: Bitcoin Cash Eyes $700 if Key $630 Resistance Breaks

Market Overview

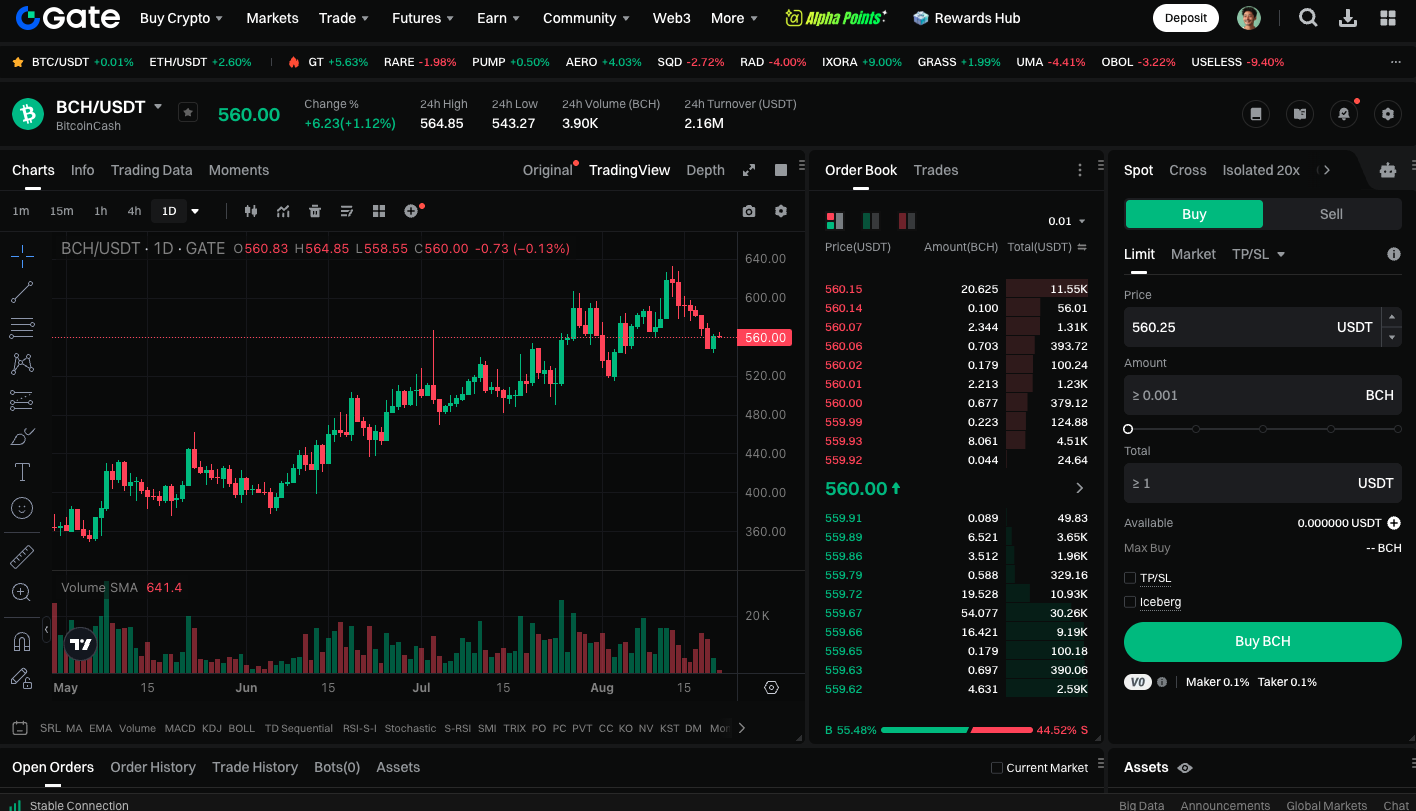

Bitcoin Cash (BCH) has recently demonstrated strong upward momentum in the market. Despite a slight short-term pullback, currently priced at approximately $560, both technical indicators and on-chain data show that bulls remain firmly in control. Analysts note that if BCH can break through the critical resistance at the previous high of $630, the price could quickly advance toward $700 or even higher levels.

Derivatives and On-Chain Data Highlight Bullish Advantage

Data from CryptoQuant shows that BCH’s Futures Taker CVD (Cumulative Volume Delta) has turned positive and continues climbing, indicating the market is now buyer-dominated. Over the past 90 days, active buying pressure has been steadily increasing, supporting the upward price trend. Similarly, CoinGlass data shows BCH open interest has surged to a yearly high of approximately $683 million, setting a new record since April 2024. The rise in OI suggests a substantial influx of new capital, which typically fuels further price appreciation.

Technical Outlook: Conditions for Sustained Bullish Momentum

From a technical standpoint, the RSI stands at 62 as of this writing—above neutral—signaling that buying strength is not yet overheated, leaving room for continued upward movement. The MACD has formed a golden cross this week, with expanding green bars confirming a strong buy signal. The $520–$540 range serves as a key support for BCH. A break below this range could lead to short-term consolidation. However, a decisive breakout above the $630 resistance would unlock the path toward $700.

Key Price Levels to Watch

- Upside targets: Surpassing $630 opens the door to $700. Sustained momentum could push prices toward the $720–$750 range.

- Downside risk: A break below $540 could trigger a test of the key psychological level at $500.

You can trade BCH spot at: https://www.gate.com/trade/BCH_USDT

Summary

Bitcoin Cash is currently consolidating around $560. With on-chain data reflecting buyer dominance and rapid capital inflows, technical indicators continue to send bullish signals. If BCH holds support and breaks above $630, it stands poised to begin a fresh rally. Targets are set at $700 and beyond.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025