XRP Price Prediction: Will XRP Break Above $3 Soon as Bullish Momentum Builds?

Is XRP’s challenge to reach 3 dollars just around the corner?

Recently, the XRP market has shown a strong rebound momentum. According to recent on-chain data, the transfer volume of XRP between accounts has reached 659 million, highlighting the intense increase in network activity. Such a surge in large-scale on-chain payments has historically been a precursor to significant price fluctuations.

XRP price key support

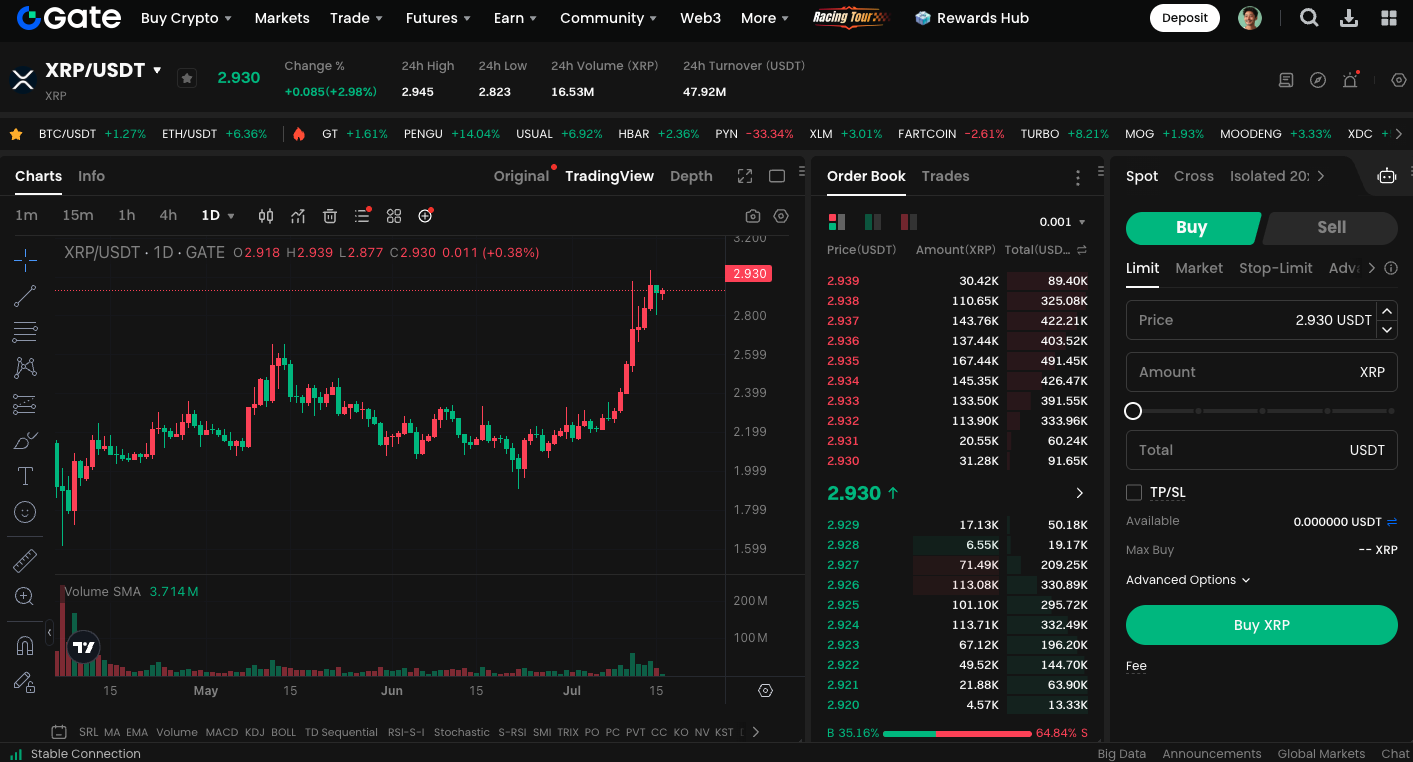

Before the deadline, the trading price of XRP was around $2.9, and it is trying to hold above the 50, 100, and 200-day moving averages to stabilize and build a base. This position not only serves as a springboard for a short-term rebound but also symbolizes the market’s strengthening confidence in the support zone. The Relative Strength Index (RSI) is approaching 60, indicating that buying momentum is accumulating, but it has not yet reached extreme levels, leaving room for further upward movement. As long as XRP can maintain above the upward trend line, the next phase of the rebound could quickly push the price towards $2.5, or even test the psychological barrier of $3.

Short-term risks cannot be ignored.

This surge in payment volume is also accompanied by potential high volatility risks. Some analysts believe this may be related to large holders rebalancing their positions, a move that has previously led to increased short-term selling pressure. If the market cannot hold above the technical support level of $2.15, the XRP price may quickly retreat to the $2 - $2.10 range, which would slow down the bullish momentum.

Fundamentals resonate with expectations

From a fundamental perspective, DeepSeek AI has a high evaluation of XRP’s prospects, predicting that the price could rise to $5 by the end of 2025, which is more than double the current price. Several key driving factors include:

- Significant progress of Ripple in the lawsuit with SEC

- International institutions’ interest in adopting XRP for cross-border payments is increasing.

- The market’s expectations for the approval of the XRP spot ETF by the United States are heating up.

- The United Nations Capital Development Fund’s recognition of XRP’s efficiency, low cost, and compliance characteristics.

Start trading XRP spot immediately:https://www.gate.com/trade/XRP_USDT

Summary

Looking at the technical aspects, capital flow, and fundamentals, XRP is in the calm before the storm. As long as trading volume continues to increase and the price can hold above the rising support line, breaking and holding above $3 will no longer be just a hope, but a reality that is being constructed. For traders, this could be the starting point of a potentially significant mid-term trend, but it’s also important to closely monitor the potential risks brought by short-term fluctuations.