What is Aspecta (ASP)? In-Depth Look at the AI-Driven Decentralized Identity and Reputation Protocol

Preface

As the blockchain market rapidly evolves, many assets remain excluded from this financial revolution. Illiquid assets like pre-TGE equity, locked tokens, unlisted stocks, and real-world assets (RWAs) have long faced challenges in valuation and liquidity.

What is Aspecta?

(Source: aspecta_ai)

Aspecta is blockchain infrastructure purpose-built for the entire asset lifecycle. It delivers intelligent attestation and price discovery, allowing previously overlooked asset types to be traded on-chain and used across various applications.

Aspecta’s Core Positioning

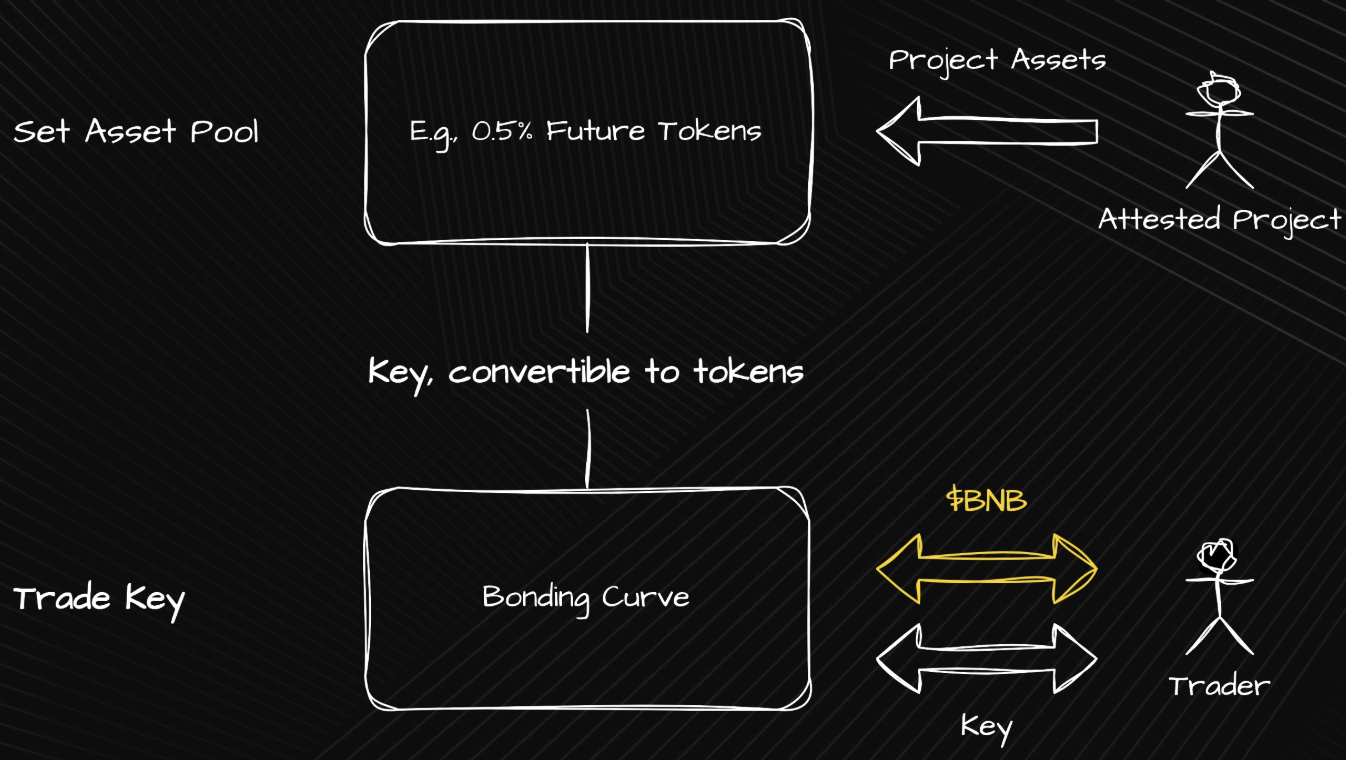

Aspecta offers a complete, structured approach to asset management—centered around its core component, BuildKey. BuildKey is a tradable on-chain token that users can redeem for multiple asset types, including:

Unissued pre-TGE equity

Locked tokens

NFTs

Private equity

Real-world assets (RWAs)

(Source: docs.aspecta)

BuildKey acts as a liquidity bridge for pricing and converting these assets. The entire trading process is built on Aspecta’s programmable asset infrastructure.

Bonding Curve Model

The price of BuildKey is dynamically adjusted using a bonding curve mechanism and features upgradeability:

Bonding Curve Phase Upgrades

When BuildKey’s market capitalization reaches specific milestones, the curve shifts to the next stage. This design ensures new participants still have potential for upside, while existing holders benefit as well.Asset Redemption Ratio Upgrades

The redemption ratio for assets improves as overall asset market cap grows. Holders do not need to take any action—both redeemed and unredeemed BuildKey tokens automatically receive the enhanced ratio benefits.Market Cap Calculation

The market cap is calculated as the current market price multiplied by circulating BuildKey supply: total market cap = price × circulating BuildKey tokens.

This ensures all participants fairly share in value growth at every stage.

Fair Launch Mechanism

To protect the community from bots and frontrunners exploiting high gas fees, Aspecta has introduced an innovative deposit-based lottery. For every new asset pool launch, the first 30 minutes are dedicated to a deposit window. Participants simply submit a refundable deposit to apply:

Each address can submit only one order, with the amount between 20 and 100 BuildKey tokens (varies by project)

All orders are randomly sorted and executed, regardless of submission time or gas price

If applications exceed the pool cap, the system automatically adjusts the allocation for each participant based on the level of oversubscription

This mechanism guarantees a level playing field and reduces the potential for bots and large holders to manipulate the market. Winners can immediately check results. They can also claim their BuildKey tokens and receive refunds. The entire process is fee-free and fully trustless.

PoH Verification and Community Badges

Users wishing to further improve their allocation chances can complete PoH (Proof of Humanity) tasks to enter the Premium deposit pool, which offers priority access. You can obtain verification by:

Completing PoH tasks

Holding a community badge issued by Aspecta

Having participated in Aspecta’s PoH test activities

Contacting the official team for special cases

This approach goes beyond technical implementation and exemplifies Aspecta’s commitment to community-driven, fair participation.

Programmable Asset Infrastructure

Aspecta is more than a trading protocol—it’s an extensible, modular platform for asset management. Asset issuers can design custom asset logic to suit their own requirements. This includes:

Customizable pricing and trading mechanisms

Configurable lockup periods and conditional releases

Setting unique asset features and integration with different use cases

Standardized interfaces for shared liquidity across multiple asset types

Aspecta also provides its core Build Attestation technology as an open API, making it easy for developers and third-party apps to plug into this trust and verification layer—expanding the reach of the Web3 ecosystem.

ASP Token Economic Model

The ASP token is native to the Aspecta ecosystem, with a fixed supply of 100 million tokens. The distribution model is designed to drive long-term growth and community governance as follows:

45% dedicated to community and ecosystem development

15% to early contributors—those supporting initial development, testing, and strategic input

20% to investors, in recognition of early capital and resource support

3% for initial liquidity, ensuring stable trading on exchanges and within the ecosystem

17% held by the foundation for future development, governance, and protocol upgrades

This design secures active community involvement and protocol safety, supporting sustainable ecosystem development.

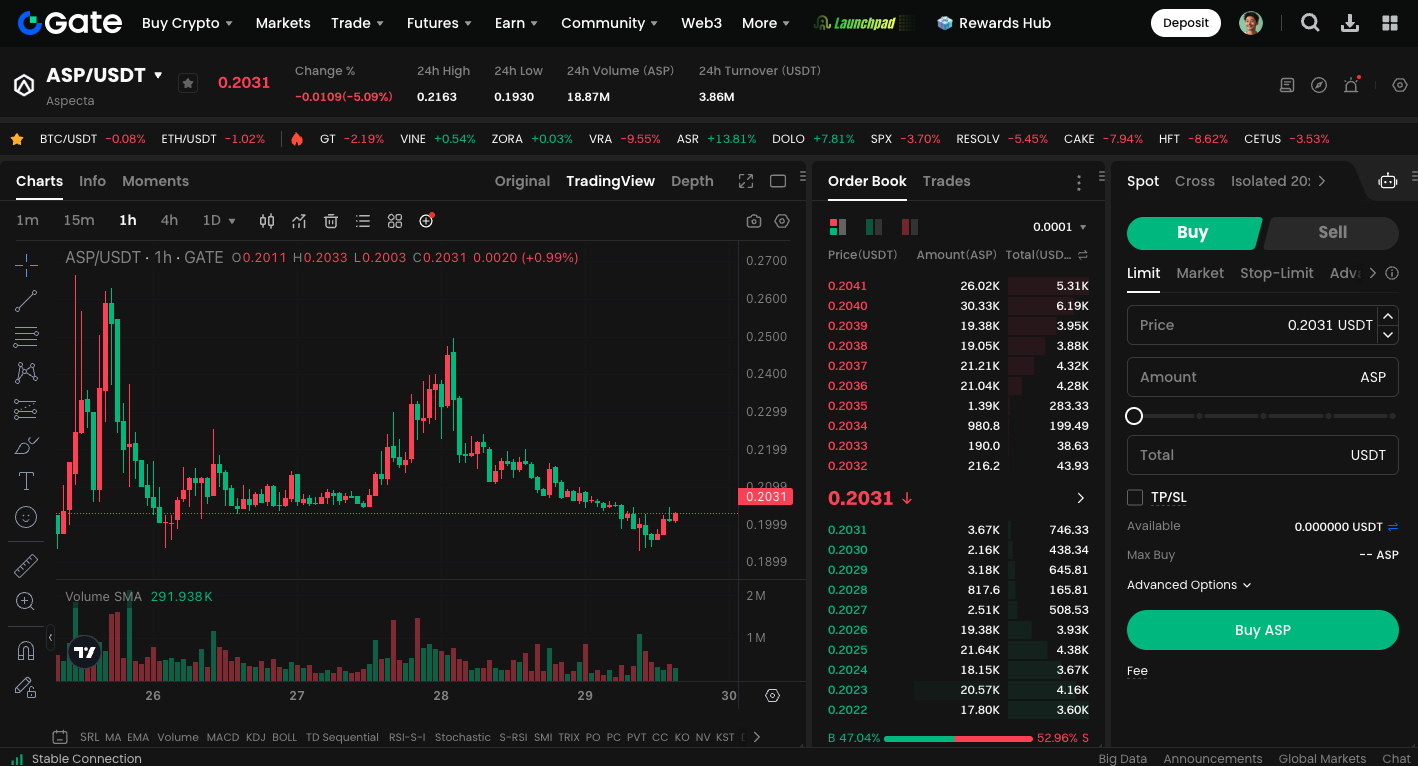

ASP spot pairs are available for trading: https://www.gate.com/trade/ASP_USDT

Summary

Traditionally, asset value was confined to closed systems or long-term vesting structures. With BuildKey’s innovative design and intelligent attestation, Aspecta injects liquidity and price discovery into hard-to-trade assets. Whether you’re a developer, early investor, or everyday user, Aspecta provides a fair, secure, and predictable participation route. As the ecosystem’s driving force, ASP unites asset management, mechanisms, and community governance and incentives into one cohesive framework.